May 15, 2020

Special COVID-19 Issue

Copyright © 2020 American Horse Council

The AHC News is provided to you as a benefit of your AHC membership, and we hope you find the articles informative and useful. While the AHC does grant permission for newsletter articles to be passed on, we hope you will encourage those you are sharing the articles and information with to join the AHC so they can stay informed and up-to-date!

Resources for Horse Owners

Attention horse owners – here is a wonderful article on best practices you can follow when heading to the barn to keep both you and barn staff safe during COVID-19. Article courtesy of Tara Swersie of Event Clinics. https://eventingnation.com/covid-19-and-best-practices-for-your-equestrian-activities/

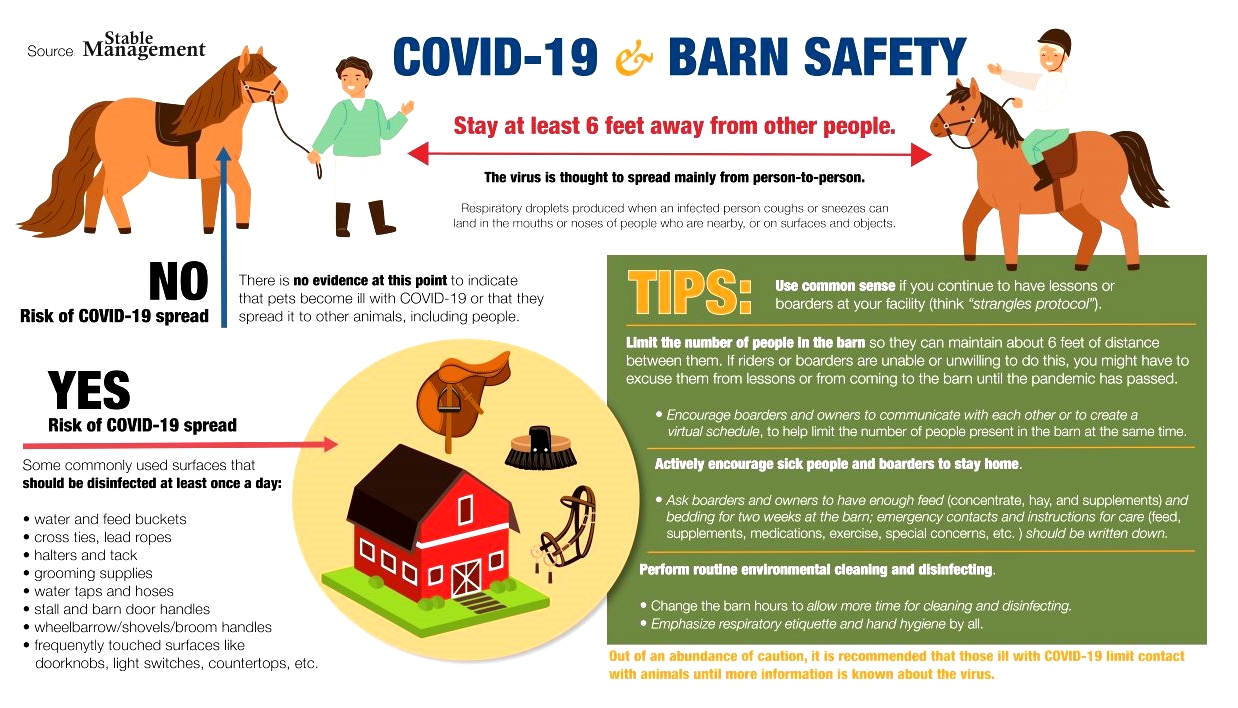

We have also included a helpful graphic about COVID-19 and Barn Safety courtesy of AAEP/Stable Management. Consider printing it and displaying it publicly in your barn. You can also download the graphic here: https://unitedhorsecoalition.org/wp-content/uploads/2020/04/COVID_19andBarn_-safety-1200×675-1-1030×579.jpg

Resources for Small Businesses

Rebuilding The Grassroots – Lesson Programs and Time To Ride

Even with states gradually reopening, it’s anticipated that most organized sports activities for kids will take weeks or months to regroup and restart. Team sports are especially questionable, as traditional activities such as baseball, football, soccer and field hockey don’t allow for social distancing. Most spring and summer season activities are already cancelled, and fall sports are questionable. This means parents are looking for easily accessible athletic activities for their children, regardless of the season. Horseback riding fits this bill. But how to connect kids with horses?

Time To Ride is an initiative of the American Horse Council’s Marketing Alliance. TTR’s purpose is to introduce school-age children to horseback riding and horse care in a safe, welcoming environment. We provide marketing materials and support to member facilities so they can publicize their lesson programs to their local markets.

The current Time To Ride program approves equine facilities and instructors as Time To Ride Program Facilities based on specific requirements, including: current professional membership with one or more national breed or discipline associations; certification as an instructor through a recognized program such as Certified Horsemanship Association; or a current riding instructor license in the state in which they teach. Barns and instructors meeting the program’s standards are designated Time To Ride Program Facilities.

To help restart the equine industry, Time To Ride is developing a second membership tier with fewer requirements. More details will be shared next week.

To learn more about Time To Ride, review the requirements and apply, visit www.timetoride.org, email ttr@horsecouncil.com, or call 202-891-7971.

Time To Ride is managed and funded by the American Horse Council Marketing Alliance. The Marketing Alliance was founded by a consortium of equine-related corporations and organizations to encourage and support the growth of the U.S. horse industry. Current members of the Marketing Alliance include: Active Interest Media/Equine Network, American Horse Council, Purina, Spalding Laboratories and Zoetis. Additional support is provided by the American Association of Equine Practitioners, American Paint Horse Association, American Quarter Horse Association, National Reining Horse Association, Troxel Helmets and Weaver Leather. Educational support is provided by Certified Horsemanship Association, United States Equestrian Federation and United States Pony Clubs.

Resources for Non-Profits

Transportation Regulatory Changes Announced

This week the Department of Transportation (DOT) made two announcements that will impact the commercial shipping of horses in the United States. The American Horse Council has been participating in cross-sector conversations with the Federal Motor Carrier Safety Administration (FMCSA) to include beneficial changes to the existing Hours of Service regulations. The 232 page announcement has addressed two key issues that they AHC was advocating for changes. Specifically, the final rule will allow more flexibility for the 30-minute rest break rule by requiring a break after eight hours of consecutive driving and allowing the break to be satisfied by a driver using “on-duty, not driving” status, rather than “off-duty” status. The rule also will modify the split sleeper berth exception to allow drivers to divide their required 10 hours off duty into two periods: an 8/2 split or a 7/3 split. Neither period would count against the driver’s 14-hour driving window. This is not the full extent of flexibility with which we were seeking, and the AHC will continue to work with the FMCSA to make the transportation of horses safer for both the drivers and the animals they haul.

This final revision involves changing the short-haul exception available to certain drivers by lengthening the drivers’ maximum on-duty period from 12 to 14 hours and extending the distance limit within which the driver may operate from 100 air miles to 150 air miles. Additionally, the rule modifies the adverse driving conditions exception by extending by two hours the maximum window during which driving is permitted. This change is very much appreciated and has been standard practice in the industry through state enforcement interpretations. This will be particularly useful for commercial breeding operations with multiple facilities in the local area.

The second announcement made this week was the FMCSA’s Emergency Declaration that exempts truck drivers hauling supplies for the COVID-19 relief effort (including those hauling livestock) from Hours of Service rules has been extended through June 14th. More information on this announcement can be found at; https://www.fmcsa.dot.gov/emergency/extension-expanded-emergency-declaration-no-2020-002-under-49-cfr-ss-39025

Please contact Cliff Williamson at cwilliamson@horsecouncil.org for more information.

Resources for Equine Associations

House Democrats Introduce Massive Stimulus, Extend Paycheck Protection to All Non-Profits

On Tuesday, May 12, House Democrats introduced H.R. 6800, also known as the HEROES Act , a $3 trillion economic relief package intended to address the COVID-19 crisis. Although the 1800-page bill will not pass into law as written, H.R. 6800 highlights key issues impacting the horse industry. These include the industry’s ongoing efforts to extend Paycheck Protection Program (PPP) eligibility to equine trade associations, rescission of an important provision within the Tax Cuts and Jobs Act of 2017, the landmark tax reform law, and expansion of tax flexibilities included in the original CARES Act.

The House Small Business Committee explains in a statement that the CARES Act, which passed on March 27, “made 501(c)(3) entities eligible for PPP loans,” thereby excluding “many nonprofits on the frontlines of the pandemic.” To address this shortcoming, the committee points out that the bill creates “a 25 percent set-aside of funds solely for nonprofits, expands the eligibility to allow all nonprofits to participate, and removes the size restrictions on nonprofits.” While many industry groups support the measure as an important lifeline to extend resources to rural and small business, critics characterize the provision as a “bailout for corporate lobbyists” and so-called “dark money.” To view a fact sheet from the House Small Business Committee, please see the following link: https://smallbusiness.house.gov/uploadedfiles/heroes_act_fact_sheet_5.12.2020_introduced_bill_final_updated.pdf.

Among other tax provisions, the bill also targets the limitation of the deduction for State and Local Taxes (SALT) included in TCJA. As you might recall, the tax reform law included a reduced itemized deduction for up to $10,000 of state and local property taxes. This provision eliminated the unlimited, longstanding deduction for state, sales and local property taxes, posing challenges for members of the horse industry who file returns in high-tax states such as California, New Jersey and New York. The SALT exclusion would apply to tax years 2020 and 2021. The HEROES Act would also enhance the “employee retention tax credit” allowing a business to claim 80 percent of eligible wages, up from 50 percent under the original CARES Act. The bill also would allow employers benefitting from loan forgiveness under Paycheck Protection to qualify for the payroll tax deferral provided by the CARES Act. Under current law, an employer must take advantage of one, or the other. To view a copy of the 90-page section-by-section summary of H.R. 6800, go to the following link: https://appropriations.house.gov/sites/democrats.appropriations.house.gov/files/documents/Heroes%20Act%20Summary.pdf

While the House bill lays down an important marker for PPP expansion, AHC, the Farm Bureau, National Dairy Herd Information Association, National Grange and Outdoor Amusement Business Association, among other groups, are advocating for coverage of 501(C)4, (C)5 and (C)6 organizations within the context of other vehicles. The coalition has identified Rep. Chris Pappas (D-NH), who sits on the House Small Business Committee, as a champion largely responsible for expansion of Paycheck Protection to include all non-profits within the context of H.R. 6800. The coalition is drafting a letter to the congressman urging him to continue to promote 501(C)4, (C)5 and (C)6 groups as other relief measures move in Congress.

While the House and Senate are headed for a stand-off as they work to find common ground on the next major relief package, many measures that will help the horse industry remain in play. Among other measures, lawmakers will continue to revise Small Business Administration programs such as Paycheck Protection and revisit adjustments to the tax code to deliver economic relief related to the COVID-19 crisis. AHC will keep you updated on developments as they unfold.

Details: Bryan Brendle at bbrendle@horsecouncil.org.

Membership Spotlight

Ada Gates Patton: First Female Farrier

Who do you know who “started her life at the top and made her way all the way to the bottom?” Our newest member, Ada Gates Patton! Growing up as the daughter of a New York “grande dame” she could have had the life of luxurious leisure; but her passion for horses led her down a different path. Ada was the first female who graduated in 1971 from farrier school and in 1978 became the first female farrier licensed to shoe racehorses in the U.S. and Canada since the inception of the International Union of Journeyman Horseshoers in 1873. She kept her head down and kept moving forward and moving forward she did! She appeared on David Letterman, was the farrier liaison for the 1984 Olympic Games in Los Angeles and the official horseshoe inspector to the Pasadena Tournament of Roses Parade. Ada received the Edward Martin Humanitarian Award in 2008 at the American Farrier’s Association Convention in Lexington, KY and was inducted into the American Farriers Hall of Fame. Ada stopped actively shoeing in the mid-1990’s but still loves to travel and lecture on shoeing and telling her story to anyone who will listen.

Our next webinar topic is “From the Front Gate to the Back Fence: How to be Your own CEO” by Scott Knudsen on Monday May 18, 2020 at 1pm EDT. To register send an email to info@horsecouncil.org

Details: Contact Lynda Majerowicz at lmajerowicz@horsecouncil.org

American Horse Council

1616 H Street NW • 7th Floor •

Washington, DC 20006 • 202-296-4031

www.horsecouncil.org

info@horsecouncil.org